Sunday, April 10, 2016

Friday, April 8, 2016

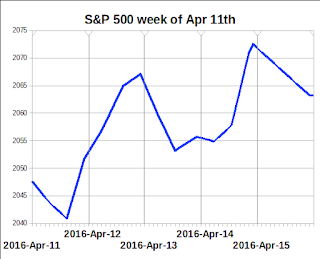

Well, we knew that eventually there would have to be an adjustment or correction.

At this time, I am unable to make a prediction as to its extent. However, a common retracement, the Fibonacci Sequence, often provides an accurate line of reference. The assumption is that the market will correct 50% of the distance from a closing low to a closing high. And as mentioned, using this method on the S&P 500 yields a downside target of about 1,950, which is 4.5% below Thursday's close.

But there are likely to be many stops along the way and plenty of opportunities for profitable trades.

Thursday, April 7, 2016

If the bulls can't do any better with the major indices than with the minors, we could be in for a long, sideways summer. The overall pattern is bullish, but there is a lack of momentum from buyers that is usually present at a breakout.

I believe stocks will eventually break to new highs. But if they do so this year, it will probably not occur until year end.

May is just around the corner and I doubt you need reminding of the oft-repeated ditty, "Sell in May and go away."

![[Report]](http://mam.econoday.com/images/mam/byconsensus_butt.gif)

![[djStar]](http://mam.econoday.com/images/mam/djstar.gif)

![[Star]](http://mam.econoday.com/images/mam/star.gif)