Sunday, December 27, 2015

Monday, December 14, 2015

Monday, December 7, 2015

Monday, November 30, 2015

Sunday, November 22, 2015

Sunday, November 15, 2015

Monday, November 9, 2015

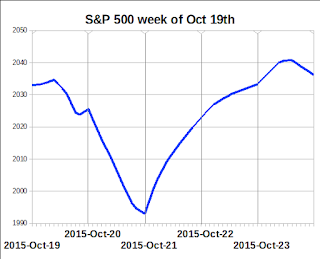

Monday, October 26, 2015

Sunday, October 18, 2015

Sunday, October 11, 2015

Sunday, October 4, 2015

Monday, September 28, 2015

Sunday, September 20, 2015

Sunday, September 13, 2015

Tuesday, September 8, 2015

Monday, August 31, 2015

Monday, August 17, 2015

Tuesday, August 11, 2015

Monday, August 3, 2015

Sunday, July 26, 2015

Sunday, July 5, 2015

Monday, June 8, 2015

Monday, June 1, 2015

Tuesday, May 26, 2015

Monday, May 18, 2015

Monday, May 11, 2015

Sunday, April 26, 2015

Monday, April 20, 2015

Monday, April 13, 2015

Tuesday, April 7, 2015

Sunday, March 29, 2015

Sunday, March 22, 2015

THIS WEEK'S MARKET MOVERS

Date ET Release For Actual Briefing.com Forecast Briefing.com Consensus Prior Revised From Mar 16 08:30 Empire Manufacturing Mar 6.9 9.0 8.8 7.8 Mar 16 09:15 Industrial Production Feb 0.1% 0.0% 0.3% -0.3% 0.2% Mar 16 09:15 Capacity Utilization Feb 78.9% 79.4% 79.5% 79.1% 79.4% Mar 16 10:00 NAHB Housing Market Index Mar 53 55 56 55 Mar 16 16:00 Net Long-Term TIC Flows Jan -$27.2B NA NA $39.2B $35.4B

Sunday, March 15, 2015

THIS WEEK'S MARKET MOVERS

Sunday, March 8, 2015

THIS WEEK'S MARKET MOVERS

time (et) report period ACTUAL CONSENSUS

forecast previous MONDAY, MARCH 9 10 am Labor market conditions index -- 4.9 12 noon Financial accounts (Flow of Funds) TUESDAY, MARCH 10 9 am NFIB small business index Feb. -- 97.9 10 am Job openings Jan. -- 5 mln 10 am Wholesale inventories Jan. -- 0.1% WEDNESDAY, march 11 2 pm Federal budget Feb. -- -$194 bln THURSDAY, march 12 8:30 am Weekly jobless claims March 7 315.000 320,000 8:30 am Retail sales Feb. 0.3% -0.8% 8:30 am Retail sales ex-autos Feb. 0.5% -0.9% 8:30 am Import price index Feb. 0.1% -2.8% 10 am Business inventories Jan. -0.2% 0.1% FRIDAY, march 13 8:30 am Producer price index Feb. 0.4% -0.8% 9:55 am Consumer sentiment index March 95.9 95.4

Saturday, February 28, 2015

Fwd: Trade Alert

DISCLAIMER. All presentations, newsletters and web site information in The Option Mentor Program are for educational purposes only. No representation is made that any software, trading method, or training will guarantee profits. The Option Mentor Program is not a licensed Broker Dealer or Registered Investment Adviser, and does not provide buy, sell, or hold recommendations, nor does it offer investment, tax or legal advice, and nothing in presentations, newsletters and web site information should be construed as such. Unique experiences and past performances do not guarantee future results. Your trading results may vary. Many of the matters discussed are subject to detailed rules, regulations, and statutory provisions, which should be referred to for additional detail and are subject to changes that may not be reflected in presentations, newsletters and web site information. In order to simplify the computations, commissions and other transaction costs have not been included in the examples used in the program. Such costs will impact the outcome of the stock and options transactions and should be considered. Trading software, trading systems and any related products discussed in The Option Mentor Program are analytical tools for educational purposes only. They are not intended to replace individual research and your personal decision to act or not to act on anything presented in the program. These tools are not a replacement for licensed investment advice. Trading stocks, options & spot currencies involves substantial risk and there is always the potential for loss. Only genuine "risk" funds, money that you can afford to lose, should be used in trading. Owners, employees and writers may have long or short positions in the securities that are discussed. The Option Mentor Program accepts no liability and will not be held liable by you for anything in presentations, newsletters or web site information. All information is obtained from sources believed to be accurate and reliable. However, errors or omissions are possible due to human and/or mechanical error. All information is provided "as is" without warranty of any kind. The Option Mentor Program makes no representations as to accuracy, completeness, or timeliness of the information. The Option Mentor Program reserves the right, in its sole discretion and without any obligation, to change, make improvements to, or correct any errors or omissions in any portion of the information from presentations, newsletters or the web site at any time. You agree to indemnify, defend, & hold harmless anyone conducting or attending any presentations from any liability associated with your involvement in The Option Mentor Program. All information contained in the program should be independently verified. By continuing to utilize The Option Mentor Program presentations, newsletters and web site information, you are stating you understand and agree to the above statements.

Monday, February 23, 2015

THIS WEEK'S MARKET MOVERS

| time (et) | report | period | ACTUAL | CONSENSUS forecast | previous |

|---|---|---|---|---|---|

| MONDAY, FEB. 23 | |||||

| 8:30 am | Chicago Fed national activity index | Jan. | -- | 0.39 (3-month) | |

| 10 am | Existing home sales | Jan. | 4.95 mln | 5.04 mln | |

| TUESDAY, FEB. 24 | |||||

| 9 am | Case-Shiller home price index | Dec. | -- | 4.7% y-o-y | |

| 10 am | Consumer confidence index | Feb. | 99.0 | 102.9 | |

| 10 am | Janet Yellen testimony at Senate | ||||

| WEDNESDAY, FEB. 25 | |||||

| 10 am | New home sales | Jan. | 465,000 | 481,000 | |

| 10 am | Janet Yellen testimony at House | ||||

| THURSDAY, FEB. 26 | |||||

| 8:30 am | Weekly jobless claims | Feb. 19 | 295,000 | 283,000 | |

| 8:30 am | Consumer price index | Jan. | -0.7% | -0.3% | |

| 8:30 am | Core CPI | Jan. | 0.1% | 0.1% | |

| 8:30 am | Durable goods orders | Jan. | 0.5% | -3.3% | |

| 9 am | FHFA home price index | Dec. | -- | 5.3% y-o-y | |

| FRIDAY, FEB. 27 | |||||

| 8:30 am | GDP revision | 4Q | 2.0% | 2.6% | |

| 9:45 am | Chicago PMI | Feb. | -- | 59.4 | |

| 9:55 am | Consumer sentiment | Feb. | 93.8 | 93.6 | |

Monday, February 16, 2015

THIS WEEK'S MARKET MOVERS

| time (et) | report | period | ACTUAL | forecast | previous |

|---|---|---|---|---|---|

| MONDAY, FEB. 16 | |||||

| None scheduled Presidents' Day | |||||

| TUESDAY, FEB. 17 | |||||

| 8:30 am | Empire state index | Feb. | 9.8 | 10.0 | |

| 10 am | Home builders' index | Feb. | 58 | 57 | |

| WEDNESDAY, FEB. 18 | |||||

| 8:30 am | Producer price index | Jan. | -0.5% | -0.3% | |

| 8:30 am | Housing starts | Jan. | 1.07 mln | 1.06 mln | |

| 9:15 am | Industrial production | Jan. | 0.4% | -0.1% | |

| 9:15 am | Capacity utilization | Jan. | 79.9% | 79.7% | |

| 2 pm | FOMC minutes | ||||

| THURSDAY, FEB. 19 | |||||

| 8:30 am | Weekly jobless claims | Feb. 12 | 289,000 | 304,000 | |

| 10 am | Philly Fed | Feb. | 8.0 | 6.3 | |

| 10 am | Leading indicators | Jan. | -- | 0.5% | |

| FRIDAY, FEB. 20 | |||||

| 9:45 am | Markit flash PMI | Feb. | -- | 53.9 | |

Sunday, February 8, 2015

THIS WEEK'S MARKET MOVERS

| time (et) | report | period | ACTUAL | forecast | previous |

|---|---|---|---|---|---|

| MONDAY, FEB. 9 | |||||

| 10 am | Labor market conditions index | Jan. | -- | 6.1 | |

| TUESDAY, FEB. 10 | |||||

| 9 am | NFIB small business index | Jan. | -- | 100.4 | |

| 10 am | Job openings | Dec. | -- | 5.0 mln | |

| 10 am | Wholesale inventories | Dec. | -- | 0.8% | |

| WEDNESDAY, FEB. 11 | |||||

| 2 pm | Federal budget | Jan. | -- | -$10 bln | |

| THURSDAY, FEB. 12 | |||||

| 8:30 am | Weekly jobless claims | Feb. 5 | 296,000 | 278,000 | |

| 8:30 am | Retail sales | Jan. | -0.6% | -0.9% | |

| 8:30 am | Retail sales ex-autos | Jan. | -0.7% | -1.0% | |

| 10 am | Business inventories | Dec. | 0.2% | 0.2% | |

| FRIDAY, FEB. 13 | |||||

| 8:30 am | Import price index | Jan. | -3.5% | -2.5% | |

| 9:55 am | Consumer sentiment | Feb. | 98.5 | 98.1 | |

Monday, February 2, 2015

THIS WEEK'S MARKET MOVERS

| MONDAY, FEB. 2 | |||||

|---|---|---|---|---|---|

| 8:30 am | Personal income | Dec. | 0.3% | 0.3% | 0.3% |

| 8:30 am | Consumer spending | Dec. | -0.3% | -0.3% | 0.5% |

| 8:30 am | Core inflation | Dec. | 0.0% | 0.0% | 0.0% |

| 9:45 am | Markit PMI | Jan. | 53.9 | -- | 53.7 |

| 10 am | ISM | Jan. | 53.5% | 55.0% | 55.1% |

| 10 am | Construction spending | Dec. | 0.4% | 0.7% | -0.2% |

| 2 pm | Senior loan officer survey | ||||

| TUESDAY, FEB. 3 | |||||

| 10 am | Factory orders | Dec. | -2.7% | -0.7% | |

| TBA | Motor vehicle sales | Jan. | 16.5 mln | 16.8 mln | |

| WEDNESDAY, FEB. 4 | |||||

| 8:15 am | ADP employment report | Jan. | -- | 241,000 | |

| 10 am | ISM nonmanufacturing | Jan. | 56.5% | 56.5% | |

| THURSDAY, FEB. 5 | |||||

| 8:30 am | Weekly jobless claims | Jan. 31 | 290,000 | 265,000 | |

| 8:30 am | Trade deficit | Dec. | -$38.7 bln | -$39.0 bln | |

| 8:30 am | Productivity | Q4 | -0.6% | 2.3% | |

| 8:30 am | Unit labor costs | Q4 | 1.6% | -1.0% | |

| FRIDAY, FEB. 6 | |||||

| 8:30 am | Nonfarm payrolls | Jan. | 245,000 | 252,000 | |

| 8:30 am | Unemployment rate | Jan. | 5.5% | 5.6% | |

| 8:30 am | Average hourly wages | Jan. | 0.3% | -0.2% | |

| 3 pm | Consumer credit | Dec. | -- | $14 bln | |

Sunday, January 25, 2015

THIS WEEK'S MARKET MOVERS

| time (et) | report | period | ACTUAL | CONSENSUS forecast | previous |

|---|---|---|---|---|---|

| MONDAY, JAN. 26 | |||||

| None scheduled | |||||

| TUESDAY, JAN. 27 | |||||

| 8:30 am | Durable goods orders | Dec. | 0.2% | -0.9% | |

| 9 am | Case-Shiller home prices | Nov. | -- | 4.6% y-o-y | |

| 10 am | Consumer confidence index | Jan. | 96.0 | 92.6 | |

| 10 am | New home sales | Dec. | 453,000 | 438,000 | |

| WEDNESDAY, JAN. 28 | |||||

| 2 pm | FOMC announcement | ||||

| THURSDAY, JAN. 29 | |||||

| 8:30 am | Weekly jobless claims | Jan. 24 | 295,000 | 307,000 | |

| 10 am | Pending home sales | Dec. | -- | 0.8% | |

| FRIDAY, JAN. 30 | |||||

| 8:30 am | GDP | Q4 | 3.2% | 5.0% | |

| 8:30 am | Employment cost index | Q4 | 0.5% | 0.8% | |

| 9:45 am | Chicago PMI | Jan. | -- | 58.3 | |

| 9:55 am | Consumer sentiment index | Jan. | 98.3 | 98.2 | |

Sunday, January 18, 2015

THIS WEEK'S MARKET MOVERS

| time (et) | report | period | ACTUAL | CONSENSUS forecast | previous |

|---|---|---|---|---|---|

| MONDAY, JAN. 19 | |||||

| None scheduled Martin Luther King Jr. Day | |||||

| TUESDAY, JAN. 20 | |||||

| 10 am | Home builders' index | Jan. | 57 | 57 | |

| WEDNESDAY, JAN. 21 | |||||

| 8:30 am | Housing starts | Dec. | 1.035 mln | 1.03 mln | |

| THURSDAY, JAN. 22 | |||||

| 8:30 am | Weekly jobless claims | Jan. 17 | N/A | N/A | |

| 9 am | FHFA home price index | Nov. | -- | 4.5% y-o-y | |

| 9:45 am | Markit PMI flash | Jan. | -- | 53.9 | |

| FRIDAY, JAN. 23 | |||||

| 8:30 am | Chicago Fed national activity index | Dec. | -- | 0.48 (3-month) | |

| 10 am | Existing home sales | Dec. | 5.04 mln | 4.93 mln | |

| 10 am | Leading indicators | Dec. | -- | 0.6% | |

Sunday, January 11, 2015

THIS WEEK'S MARKET MOVERS

| time (et) | report | period | ACTUAL | CONSENSUS forecast | previous |

|---|---|---|---|---|---|

| MONDAY, JAN. 12 | |||||

| 10 am | Labor market conditions index | Dec. | -- | 2.9 | |

| TUESDAY, JAN. 13 | |||||

| 9 am | NFIB small business index | Dec. | -- | 98.1 | |

| 10 am | Job openings | Nov. | -- | 4.8 mln | |

| 2 pm | Federal budget | Dec. | -- | $53 bln | |

| WEDNESDAY, JAN. 14 | |||||

| 8:30 am | Retail sales | Dec. | -0.2% | 0.7% | |

| 8:30 am | Retail sales ex-autos | Dec. | 0.0% | 0.5% | |

| 8:30 am | Import prices | Dec. | -2.5% | -1.5% | |

| 10 am | Business inventories | Nov. | 0.4% | 0.2% | |

| THURSDAY, JAN. 15 | |||||

| 8:30 am | Weekly jobless claims | Jan. 9 | 303,000 | 294,000 | |

| 8:30 am | Producer price index | Dec. | -0.5% | -0.2% | |

| 8:30 am | Empire state index | Jan. | 5.0 | -3.6 | |

| 10 am | Philly Fed | Jan. | 19.8 | 24.5 | |

| FRIDAY, JAN. 16 | |||||

| 8:30 am | Consumer price index | Dec. | -0.4% | -0.3% | |

| 8:30 am | Core CPI | Dec. | 0.1% | 0.1% | |

| 9:15 am | Industrial production | Dec. | -0.2% | 1.3% | |

| 9:15 am | Capacity utilization | Dec. | 79.8% | 80.1% | |

| 9:55 am | Consumer sentiment | Jan. | 95.0 | 93.6 | |